For many of us, credit scores are not just a number; they reflect our financial future. Your credit score can influence everything from securing a loan for your dream home to receiving a competitive interest rate on a car loan. Yet for millions of African Americans, this seemingly simple number carries a heavy weight, often tied to systemic financial inequalities and historical barriers. Unfortunately, this often results in lower credit scores, which can prevent many from accessing the financial resources they need to build wealth, start businesses, or even secure decent housing.

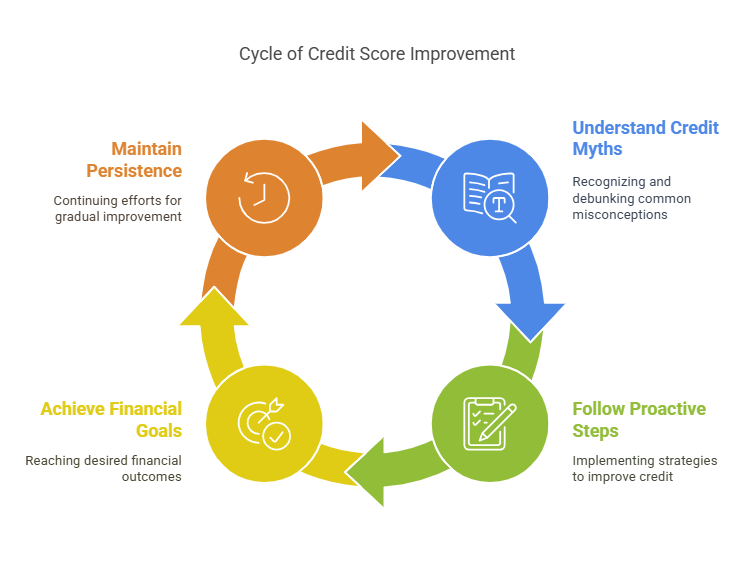

The good news? It’s possible to take control of your financial destiny and improve your credit score. Understanding how credit works, the factors that influence it, and the strategies to repair and maintain it can make all the difference in your financial journey.

In this article, we’ll break down the truth about credit scores, explore why many African Americans are affected by poor credit, and provide actionable steps you can take to clean up your credit and build a strong financial future.

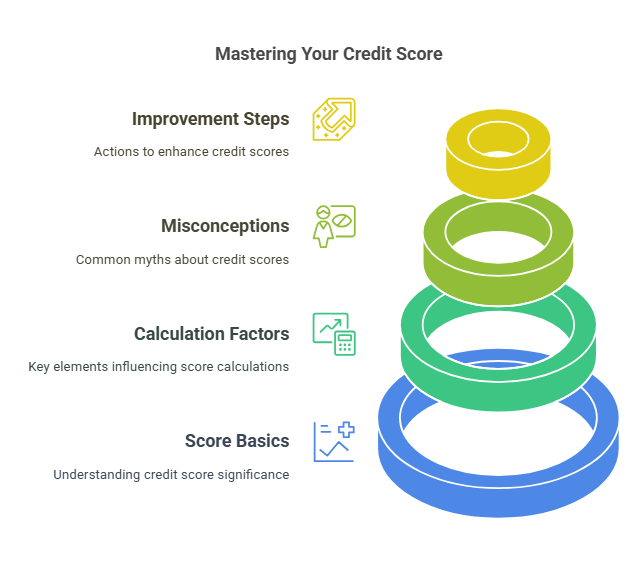

Understanding Credit Scores: What Do They Really Mean?

Credit scores are numerical representations of how likely you are to repay borrowed money on time. These scores are calculated by credit bureaus based on your financial behavior, and they serve as an indicator of your reliability as a borrower.

The most used credit scoring model in the U.S. is the FICO score, which ranges from 300 to 850. Let’s break down what these scores mean and how they impact your financial life:

- Excellent (800-850): You’ll get the best possible interest rates and have access to the most favorable credit terms.

- Very Good (740-799): You qualify for favorable interest rates and have excellent borrowing options.

- Good (670-739): You’ll still receive competitive rates but may not have access to the best offers.

- Fair (580-669): You may face higher interest rates and more restrictions on credit.

- Poor (300-579): Your credit options are limited, and you’re likely to face the highest interest rates and difficulties securing loans.

It’s important to note that FICO scores are not the only credit scores that lenders use, but they are the most widely accepted by financial institutions.

Key Factors That Affect Your Credit Score

Your credit score isn’t based on a single number but rather a combination of various factors. Understanding these key elements can help you navigate the process of improving your credit score:

- Payment History (35%): This is the most significant factor in determining your credit score. It includes whether you’ve paid your bills on time. Late payments, bankruptcies, and foreclosures can negatively impact this section of your score.

- Amounts Owed (30%): This refers to the amount of debt you owe compared to your total available credit. This is also known as your credit utilization ratio. A high ratio can indicate to lenders that you may be overextended and could struggle to pay back additional debt.

- Length of Credit History (15%): The longer your credit history, the better it is for your score. This factor considers the average age of all your accounts and the length of time since your oldest account was opened.

- New Credit (10%): If you’ve recently opened new credit accounts, it can temporarily lower your score. Opening too many accounts in a short period signals to lenders that you may be taking on too much new debt too quickly.

- Types of Credit in Use (10%): This refers to the different types of credit accounts you have—credit cards, mortgages, auto loans, etc. A mix of credit types shows lenders that you can manage different forms of credit responsibly.

Why Is Your Credit Score Important?

Your credit score plays a pivotal role in determining your financial options. Here’s why it matters:

- Loan Approval and Interest Rates: A high credit score means you’re more likely to be approved for loans, such as mortgages and auto loans. It also means you’ll get lower interest rates, saving you money over time.

- Rental Applications: Landlords often check your credit score to determine whether you’re a reliable tenant. A poor credit score can make it harder to secure a rental property, especially in competitive housing markets.

- Employment Opportunities: Some employers use credit checks to evaluate job candidates, particularly in financial, managerial, and leadership roles. A poor credit score could limit your job prospects, even if you’re otherwise qualified.

- Financial Flexibility: A good credit score gives you access to higher credit limits, which can be essential in emergencies or when seeking favorable financing terms.

The Credit Crisis in the African American Community

Despite the importance of credit, studies show that African Americans disproportionately face barriers to achieving good credit scores. According to FICO and the Federal Reserve, African Americans are far more likely to have lower credit scores compared to their white counterparts. In fact:

- 40% of Black Americans have a FICO score of 600 or lower, compared to just 25% of white Americans.

- The average FICO score for African Americans is 30 to 50 points lower than the national average.

- A 2019 report from the Urban Institute revealed that Black consumers are more likely to experience negative credit events such as delinquencies and charge-offs, largely due to historical and systemic economic disparities.

The Impact of Systemic Economic Inequality

The financial challenges faced by African Americans are rooted in a combination of factors, including income inequality, unemployment rates, limited access to credit, and the lingering effects of past discriminatory practices such as redlining. These systemic issues make it more difficult for many Black individuals to build wealth or even gain access to affordable financial services.

This financial inequality has compounded the challenges of building credit for many African American families. As a result, millions of African Americans find themselves trapped in a cycle of poor credit, which limits their ability to accumulate wealth or create a secure financial future.

The Pitfalls of Poor Credit

Having a poor credit score can have lasting consequences in your financial life. Here are some of the pitfalls associated with poor credit:

1. Higher Interest Rates

One of the most immediate effects of having a low credit score is the higher interest rates you will face when borrowing money. This applies to credit cards, auto loans, and mortgages. While someone with excellent credit might qualify for a car loan at an interest rate of 4%, a person with poor credit might be looking at rates of 15% or higher.

2. Difficulty Renting a Home

Landlords often perform credit checks as part of their tenant screening process. A poor credit score can make it harder to secure a rental property. Even if you can find a place to rent, you may be asked to pay a larger security deposit or be denied altogether.

3. Limited Credit Opportunities

With a low credit score, you may be denied access to credit cards, auto loans, or even student loans. If you are approved for credit, it may come with unfavorable terms, including high interest rates and low credit limits.

Many employers, especially those in financial or managerial fields, perform credit checks as part of the hiring process. Poor credit may signal to potential employers that you lack responsibility or are struggling financially, which could negatively impact your chances of being hired.

5. Higher Insurance Premiums

Some states allow insurance companies to use credit scores to determine premiums for auto and homeowners’ insurance. Individuals with poor credit are often charged higher premiums, simply because they are seen as higher risk.

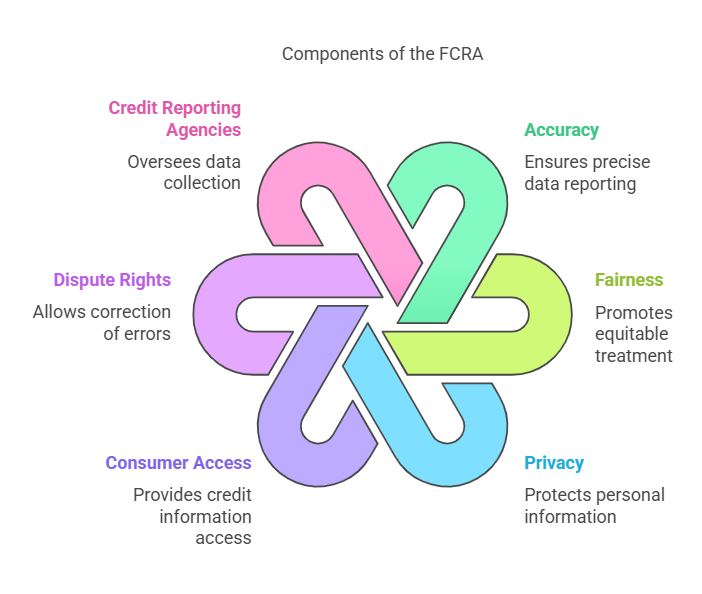

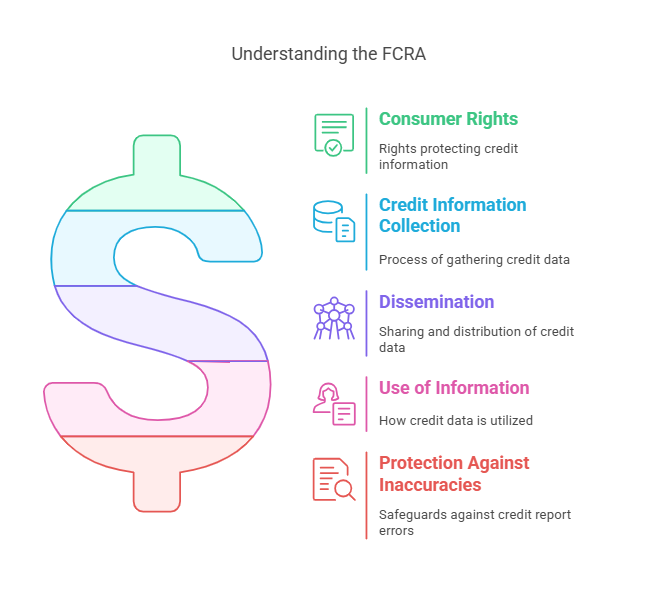

Your Rights Under the Fair Credit Reporting Act (FCRA)

When it comes to managing your credit and dealing with credit reporting agencies, it’s important to know your rights. The Fair Credit Reporting Act (FCRA) is a federal law that regulates how credit information is collected, shared, and used. Understanding the protections granted under the FCRA can help you advocate for yourself if you find discrepancies or face unfair treatment from creditors or credit bureaus.

What Is the Fair Credit Reporting Act (FCRA)?

4. Job Prospects

The FCRA was passed in 1970 to promote accuracy, fairness, and privacy in the collection of consumer information. The law is designed to protect consumers from inaccurate or misleading credit reports, as well as to provide individuals with certain rights regarding their credit data. The FCRA is enforced by the Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB).

Your Key Rights Under the FCRA

- The Right to Access Your Credit Report: You have the right to obtain a copy of your credit report from each of the three major credit bureaus—Experian, Equifax, and TransUnion—once every 12 months, free of charge. This helps you identify any errors or discrepancies and ensures that you can act swiftly to correct them.

- The Right to Dispute Inaccuracies: If you find any mistakes in your credit report, the FCRA gives you the right to dispute them. Credit bureaus are required to investigate the dispute and correct any inaccuracies within 30 days. If the credit bureau does not respond or refuses to remove the error, you can take legal action.

- The Right to Be Informed of Negative Information: If a negative item, such as a late payment or collection account, is added to your credit report, you must be notified by the credit reporting agency. This gives you the chance to dispute the information or request that it be removed if it is incorrect.

- The Right to Privacy: The FCRA protects your privacy by limiting who can access your credit report. Generally, only those with a permissible purpose, such as lenders, employers, or insurers, are allowed to view your credit report. Additionally, you must provide consent before an employer can check your credit report for employment purposes.

- The Right to Add a Consumer Statement: If you have a dispute with information on your credit report, the FCRA allows you to add a statement explaining your side of the story. This statement will be included in your credit file and visible to potential creditors.

What a Collection Agency Can and Cannot Do

Dealing with collection agencies can be a stressful experience, especially when you’re trying to improve your credit score. It’s important to understand what collection agencies can and cannot do under the law.

What a Collection Agency Can Do:

- Contact You About Your Debt: Collection agencies are allowed to contact you in writing, by phone, or in person regarding an outstanding debt. However, they are required to follow certain rules to ensure their communication is fair and respectful.

- Report Debt to Credit Bureaus: If you fail to pay a debt, collection agencies can report it to the credit bureaus. This will negatively impact your credit score. However, if you settle the debt or pay it off, it may be removed from your report after seven years.

- Offer Debt Settlement or Payment Plans: Collection agencies may offer payment plans or settle the debt for a lesser amount. While these options may help reduce your debt, they can still have a negative impact on your credit score.

What a Collection Agency Cannot Do:

- Harass or Threaten You: Collection agencies cannot engage in harassment, such as calling you repeatedly or using obscene language. They are prohibited from threatening physical harm or making false statements about the debt.

- Call at Inconvenient Times: Collection agencies cannot contact you before 8 a.m. or after 9 p.m. without your consent. If you request that they stop calling, they must honor your wishes.

- Collect Debt You Do Not Owe: Collection agencies cannot attempt to collect a debt that isn’t yours or one that has been paid off. If you believe you’ve been wrongly contacted, you have the right to dispute the debt.

- Add Unreasonable Fees: Collection agencies cannot add excessive fees or interest beyond what is outlined in your original agreement. If they do, you may have grounds to dispute the charges.

How to Fix Your Credit: Action Steps to Take Today

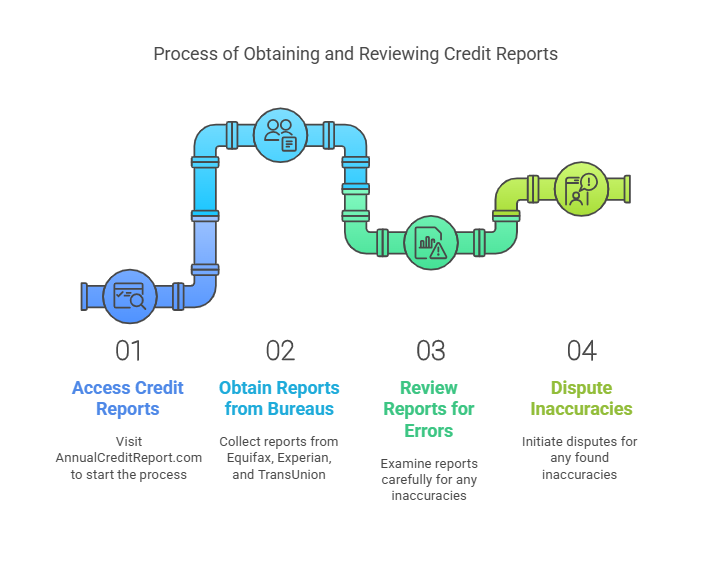

Once you have a full understanding of your credit report, the next step in improving your credit score is to address any inaccuracies and take proactive steps to resolve any outstanding issues. One of the most effective methods of improving your credit report is by disputing errors and correcting any inaccuracies that may be negatively affecting your score.

Step 1: Get Your Free Credit Reports

The first step toward fixing your credit is to obtain a copy of your credit reports. You are entitled to a free credit report once a year from each of the three major credit bureaus—Experian, Equifax, and TransUnion. The best place to request these reports is through the official government website, AnnualCreditReport.com.

Once you have your credit reports, carefully review each one for any inaccuracies, such as:

- Incorrect personal information (e.g., wrong address, name, or employer)

- Unfamiliar accounts or accounts that do not belong to you

- Late payments or delinquencies that were actually paid on time

- Duplicate accounts (e.g., an account reported twice)

- Debt that has already been paid off but is still reported as outstanding

Step 2: Dispute Inaccurate Information

If you find errors, disputing those items is your next step. Here’s a detailed breakdown of how the dispute process works, what to expect, and the laws that govern these disputes:

How to Dispute Errors on Your Credit Report

Disputing errors in your credit report involves notifying the credit bureau(s) of the discrepancies and asking them to investigate the accuracy of the information. You can dispute information online, by mail, or by phone, but written disputes are usually the most effective because they provide a paper trail and ensure a formal review.

Here’s how you can dispute an item in your credit report:

- Gather Documentation: Before disputing, gather any evidence that proves the error. For example:

- Bank statements or payment confirmations showing payments you made on time

- Letters or emails from creditors confirming an account was settled or closed

- Receipts or correspondence showing that a charge is incorrect

- Copies of legal documents (e.g., bankruptcy discharge or payment agreements)

- File Your Dispute: Once you have your supporting documents, file your dispute. The credit bureaus provide online forms for submitting disputes. You can also submit disputes by mail using certified mail to ensure your documents are received and tracked. Here’s how to file with each bureau:

- Experian: Visit Experian’s website and create an account to submit a dispute online.

- Equifax: You can submit your dispute online through Equifax’s dispute portal or by mail.

- TransUnion: Dispute errors directly on TransUnion’s website or send a physical letter.

You’ll need to specify the items you’re disputing and provide your evidence. Clearly state why the information is incorrect and what you believe the correct information should be.

- Keep Records: Be sure to keep a copy of your dispute submission, supporting documents, and any correspondence you receive from the credit bureau. This will help you track the progress of your dispute and serve as proof in case further action is needed.

- Dispute Multiple Errors: If your report has multiple errors, you can file disputes for each item individually. Some credit bureaus allow you to dispute multiple items on a single form, while others may require separate forms for each issue.

What to Expect During the Dispute Process

Once you file your dispute, the credit bureau is required by law to investigate your claim within a reasonable timeframe, typically 30 days from the date they receive your dispute. Here’s what will happen:

- Credit Bureau Investigation: The credit bureau will contact the creditor or data furnisher (the company that reported the information) to verify the disputed information. This could involve contacting the lender, utility company, or collection agency that reported the item.

- Response Time: The credit bureau is legally required to respond to your dispute within 30 days. If they do not respond or fail to resolve the dispute within this timeframe, they must remove the disputed information from your report until the issue is resolved.

- Outcome Notification: After the investigation, the credit bureau will send you a written notice detailing the outcome of the dispute. If the error is corrected, they will send you an updated credit report reflecting the changes. If the dispute is not resolved in your favor, they will explain why the information was not changed.

The Role of the Creditors

If the credit bureau determines that the disputed information is accurate (based on the response from the creditor or data furnisher), your dispute may be rejected. This can happen if the creditor provides evidence that the information in your report is correct.

If this occurs, you have the right to challenge the findings or file a second dispute. It’s important to ensure that you have all necessary documentation to support your claim in future disputes.

Step 3: Understand the Laws Governing Credit Disputes

The Fair Credit Reporting Act (FCRA) is the federal law that governs the credit dispute process and ensures that credit reporting agencies follow specific rules when handling your disputes. Here are the key provisions under the FCRA that protect you:

The FCRA and Your Rights:

- Right to Dispute Information: Under the FCRA, consumers have the right to dispute inaccurate or incomplete information on their credit reports. If you believe that a creditor or data furnisher is reporting false information, the credit bureaus must investigate the issue.

- Right to a Response Within 30 Days: The credit bureaus are required to complete their investigation and resolve your dispute within 30 days of receiving your request. If they fail to do so, they must remove the disputed information from your credit report.

- The Duty to Correct Errors: If a credit bureau identifies that an item on your report is inaccurate, it must correct or remove that information. For example, if you dispute a late payment that was reported inaccurately and the creditor cannot provide proof, the bureau must delete that late payment from your credit history.

- Right to Add a Consumer Statement: If a dispute is not resolved in your favor, you have the right to add a consumer statement to your credit report. This statement can explain your side of the story and will appear on your report whenever potential creditors review it.

- Right to Free Reports: If your dispute results in a change to your credit report, you are entitled to receive a free updated copy of your report from the credit bureaus. This is to ensure that the changes were accurately reflected and that you have the latest information.

- Right to Dispute Inaccurate Information with the Data Furnisher: If the credit bureau doesn’t resolve your dispute in your favor, you can also directly dispute the inaccurate information with the company that reported it (e.g., your bank or the creditor). They must investigate your claim and provide a response within 30 days.

Step 4: What Happens After the Dispute is Resolved?

Once the credit bureau completes the investigation, you will receive an official notice outlining the results. If the dispute was resolved in your favor, the item in question will be corrected, removed, or updated on your credit report.

Possible Outcomes of a Dispute:

- Correction or Removal of Incorrect Information: If the credit bureau determines that an item was inaccurately reported, it will be corrected or removed from your credit report.

- No Change to Your Credit Report: If the credit bureau determines the information is accurate, no changes will be made. However, you have the right to dispute again if you believe the error has not been resolved.

- Permanent Removal of a Negative Item: In some cases, an item that is old (e.g., a debt older than 7 years) may be removed entirely from your credit report if it no longer meets the legal requirements for reporting.

Step 5: Keep Monitoring Your Credit Report

Even after successfully disputing an error, it’s important to keep monitoring your credit report. Mistakes can be reintroduced, or new issues can arise. Use free monitoring services or subscribe to a paid service to ensure your credit report is accurate and up-to-date.

Step 6: Consider Seeking Help if Needed

If the dispute process feels overwhelming or if you encounter obstacles, it might be a good idea to consult with a credit repair professional or a non-profit credit counseling agency. They can help guide you through the process and ensure you follow all necessary steps to improve your credit score.

By understanding the dispute process, your rights under the FCRA, and how the credit bureaus are legally obligated to respond, you can better manage your credit report and ensure that it accurately reflects your financial history. Following these steps will not only help you fix errors but also empower you to take control of your financial future.

If you are diligent and patient, correcting errors on your credit report can lead to significant improvements in your credit score and open doors to better financial opportunities.

Conclusion: Your Path to Financial Freedom

Improving your credit score is a journey, but it’s one that can be completed with patience, persistence, and the right knowledge. By understanding your rights, disputing errors, paying down debts, and making informed decisions, you can take charge of your financial future. Whether you’re working to buy a home, secure a loan, or simply improve your financial standing, remember that a healthy credit score is within your reach.

Your credit is not just a number, it’s your financial passport, and by learning how to manage it effectively, you can unlock doors to greater opportunities.

By George Dillon, CEO Capgro Bookkeeping Services LLC

Disclaimer:

The information provided in this article is for educational and informational purposes only and is not intended as legal advice. While every effort has been made to ensure the accuracy of the content, laws regarding debt collection, statutes of limitations, and consumer rights can vary by jurisdiction and may change over time. Therefore, it is recommended that you consult with a qualified attorney or legal professional to obtain advice tailored to your specific situation. This article does not establish an attorney-client relationship and should not be relied upon as a substitute for professional legal counsel. If you are facing debt collection issues or legal concerns, please seek advice from a licensed attorney who specializes in consumer law.